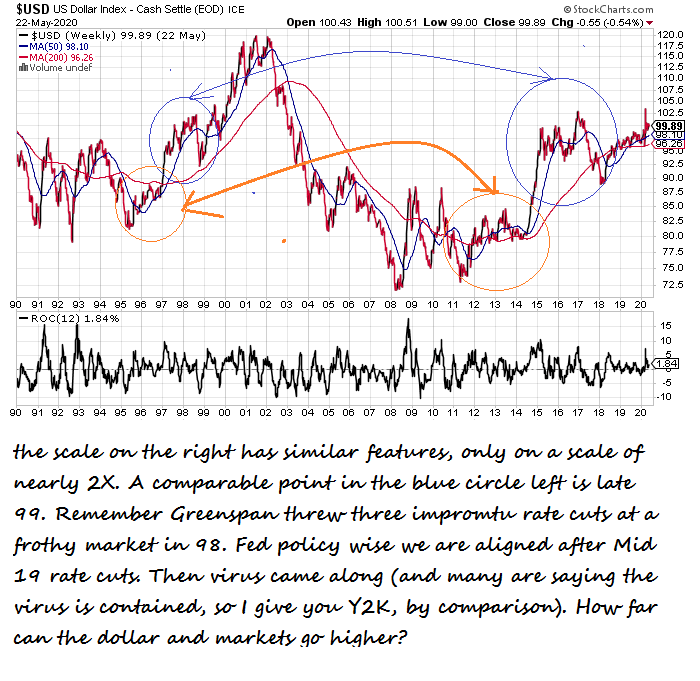

Some analysts are sure the dollar is going lower. News flash the dollar has been going lower in terms of purchasing power, which implies the dollar is worth more, it takes more dollars to buy a dollar. I would say the Bernanke program of sterilization using Treasury bonds for cash, did a lot to create this inverse relationship in value implied vs nominal value. Also the removal of wage inflation during the great offshoring of labor removed any inflationary blow back associated with trade deficits.

The 98-00 time frame is working, including Y2K, in this instance the virus. Everyone is pretty sure we are going to get through this. A lot of work went into preparing for Y2K. It is always hard to judge how good your plans are when you succeed. Say it is 1933 and you awake in a hotel room in Berlin, with a high powered rifle and a clear view of a Hitler rally. Knowing what you know now, you take aim and fire.

The Third Reich dissolves, but no one knows the horrors that were circumvented. You go down as a footnote in history.

We aren’t sure what trouble we saved ourselves, but it is becoming evident, and a second wave of virus infections should make that benefit clear. Secondarily, the loss of economic activity has created improved air quality. In the coming months and years we will get a glimpse of what that brief respite from pollution means for climate change, and if the numbers show a beneficial trend, it will be hard to remain a climate denier.

Additionally we are getting a picture of our national health. Minorities are not showing up as well against the virus, despite rising standards of living. This vulnerability may prove that we have more to do on the issue of equality. Throwing senior under the bus is a bad mistake politically. The elderly are more conservative and they have more money, per capita. In the span of my lifetime, the economic plight of seniors has improved, dramatically. This equates to empowerment.

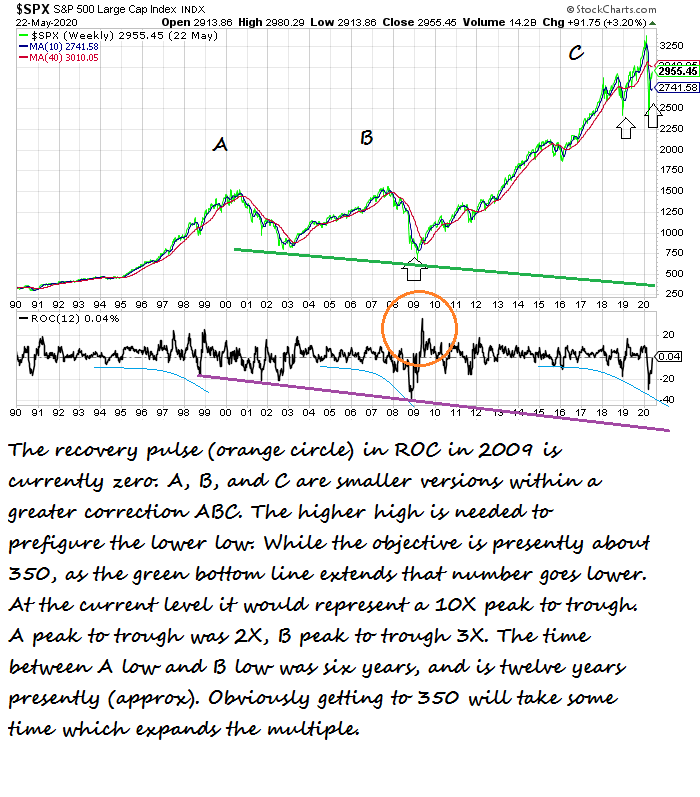

The financial crisis is still a red herring, money has been promised, to prop up stock markets, which has done nicely enough without massive bailouts. The problem lies with Federal Reserve authority, Congressional oversight, and the upcoming election. Who ultimately wrestles control of the spending, and which direction does it go? Main St or Wall St. For the moment many of these programs are unsubscribed or under subscribed. The REPO discount window is currently nothing. No wonder we are seeing “distribution” in stocks.

The automatic solution to this expansion of government monetary largesse calls for retail consumers to buy gold. The Fed is printing money, but are they really?

Comparisons to 2009 are being stretched. The nature of the crisis and even the depth of government support which may be overstated. Doing whatever it takes is a non sequitur. No one knows what IT is, and doing something based on an indefinite pronoun, implies you can always accomplish your goals.

The price of gold should be a lot higher. If this is the ebullient phase 2 of the GFC, the price of gold might have pulled back 50%, and that didn’t happen either. Not sure what gold’s behavior means, or the rise in the price of oil. Lower interest rates and direct buying of corporate bonds will only push oil prices lower until some resolution in monetary policy occurs, or an even greater depression. Cost of storage exceeds the value of the commodity.

Here’s my Gold Manifesto, short version. The traditional reasons for buying gold; runaway inflation, bank failure, chaos and famine, are not the real reasons to own the metal.

Gold is denominated in it’s own sovereign currency. When you buy gold you are hoping to gain more of those fiat dollars you assume are worthless. What is the point of that?

If a loaf of bread sells for a gram of gold, would you rather be a buyer or seller of bread?

The psychology of gold in Christian culture has always taken the same concern, with the worship of false idols. However in the rest of the world gold represents a certain spiritual wholeness, and gold is a holy object. The poor love gold most of all, and we are all going to be a lot poorer.

While the objects of communication become more complex, and more difficult to use, and have no translatable forms, they lose their value. Smoking is a form of social communication. A cellphone is a direct means of communication, while language represents a curious affront to real communication, we resort to indirect and metaphorical signals. The Iphone is a symbol of what? Being eternally plugged into a higher power? Every NBA player knows, the gold jewelry does the talking for you.

The supply of people relative to the supply of gold has been widening. Ask any central banker if you had all the gold in the world, and you could back all the currencies, how much would that be? Gold is the one commodity which allows you to print (or mine) your own money. The Protestant Reformation in the church of fiat is underway.

Having a lot of gold is not really any better than having some gold. Most financial advisors continue to recommend 5%. Imagine what happens when they have a collective epiphany and raise that allocation to 10%, or more? Gold becomes the universal consumer product. Do you really need all that toilet paper you bought last month? Gold is then somewhat anti-materialism.

That’s most of it, supply, demand and psychology. Next up is defining the nature of the bull market in gold. This is where the real wealth will be made.