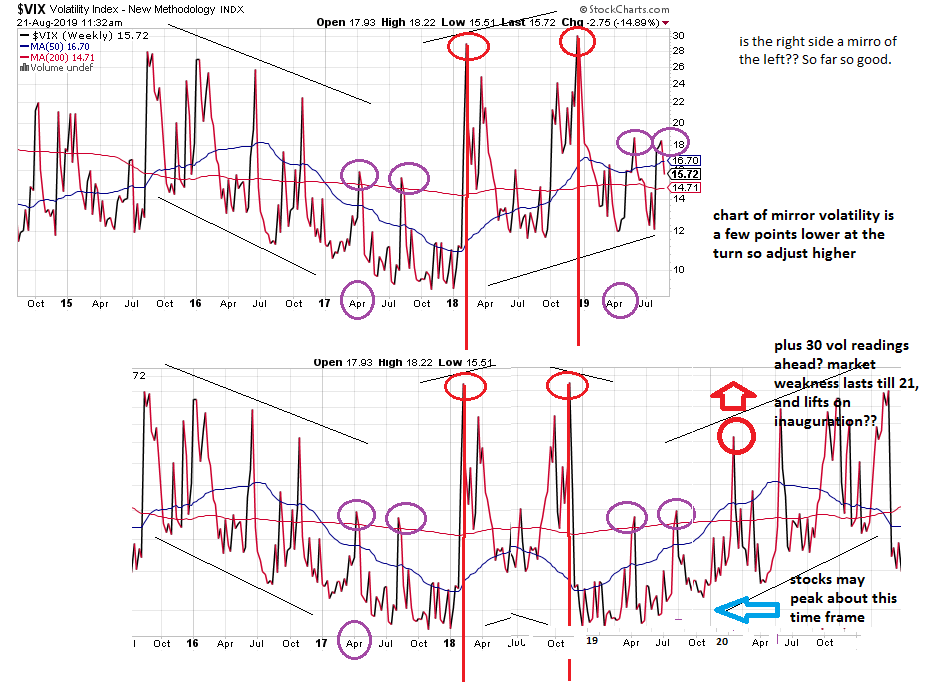

Some thinking VIX may go to triple digits, and while it may not happen in this selloff, by the mirror image it will happen (probably) later this year. This looks like a tough year according to the mirror of the VIX and the facts seems to fulfilling the prediction. You can read the entire VIX mirror post, which seems like one of those funky charts with no rhyme or reason. Why would a market unwind is a mirror image of itself on the way higher?? Somewhere about this time the US monetary base peaked. My thesis has been there are no animal spirits in this market, just fiat dollars created in largesse. The animal spirits are reserved for the downside.

The chart missed the January spike so does the whole thing just slide down the right side or do we maintain our course? The Fed started it’s massive REPO policies in September and that may have extended the peak in volatility by a few months. Anecdotally I notice that the steepness of the decline in money (A/D) suggests we are in a later stage of the crash, and that perhaps the last month or two of gains in the S&P were an entirely unsustainable rally which the fundamentals were in the process of undercutting. The candle gets brighter just before it goes out.

The way trend lines are collapsing we could get to SPY 210 in a hurry. There is a disconnect between futures traders and market traders. Today was a good example, after being down 7% at the open, buyers stepped in, bought the dip and found a nice rally. Then as we approach the end of the day, which gives way to night, and the overnight futures traders once more, the rally fizzled.

We might read something into backwardation of Silver prices. Silver futures are lower than current prices. It is said to be a demand issue. There is also a demand issue in stock shares available to short. You could insert short interest in stocks, for Silver, and there might be a valid comparison. Short interest is nearly synonymous with the VIX, or volatility. The VIX has currently gotten ahead of itself, but could still overshoot the old high in 2008, in the 60s and go into the 100s.

Such a move in VIX, it is thought would ignite a massive rally, as Volatility collapsed, even if it only collapses a little. The Fed has some benchmark terms which are abstract, and inscrutable. One of them is “stability”. What does that mean? Usually it means higher prices. With the S&P at 2000 do you want stability? Are you satisfied to merely stop the bleeding?

I have said in other contexts that the enemy of this market, and your wealth, is Volatility. The Fed has even begun to embrace volatility with it’s new CPI compensating inflation target policy. That is if inflation drops to 1%, while your benchmark is 2%, you want to try and rodeo that number up to 3% for a period of time which allows the future target rate to revert to it’s mythical mean. Another volatility issue is the huge volume of money parked in bond funds, where traders can exit, or try to exit, on a moments notice. Bond funds are not supposed to be this liquid. The resulting volatility could easily freeze up the bond market.

In the energy sector the collapse of oil prices will lead to impingement of the corporate bond sector and probably impact all corporate funding However once you shut down the over capacious build out in energy (Chesapeake Energy) built on cheap credit, then supply suddenly tightens. It takes time, effort and investment to pump energy out of the ground. The system once broken, will take time to restart. We go from deflation to inflation. Lost jobs and higher prices. The Fed meanwhile has dropped rates to zero, which is the following context becomes wildly inflationary. The Fed and it’s 2 standard deviation counter monetary policy strategy acts to widen the swings. The result is a freezing up, as all parties step aside.

The same problem exists for the BIS in the currency markets. Volatility in currency exchanges could hold up transfers. Volatility is the enemy, and a vice, according to Alexander Pope….

“Vice is a monster of so frightful mien

As to be hated needs but to be seen;

Yet seen too oft, familiar with her face,

We first endure, then pity, then embrace.”

To return to the VIX mirror analogy, the rise in Volatility was a bit late. When Volatility pulls back slightly, the market may rally only to find itself staring at the same monster. The mirror implies high volatility all year peaking and dropping at the inauguration. Something will happen next January which will finally bring about some resolution to what looks like a really tough year ahead for stocks.

Great analysis and an exciting reading.

LikeLike